Is Costco Car Insurance Cheaper Than GEICO or Progressive? sets the stage for this captivating narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset.

The comparison between Costco, GEICO, and Progressive car insurance coverage options, pricing structure, customer satisfaction, availability, accessibility, and additional benefits will provide valuable insights for informed decision-making.

Introduction

Costco car insurance is a unique option for those looking for coverage, offering competitive rates and benefits to its members. In this analysis, we will compare Costco car insurance with two major competitors, GEICO and Progressive, focusing on the cost aspect to help you make an informed decision.

Costco Car Insurance Overview

- Costco partners with CONNECT, powered by American Family Insurance, to offer auto insurance to its members.

- Members can enjoy benefits such as roadside assistance, lifetime renewability, and more.

- Discounts are available for Costco members, potentially leading to cost savings.

GEICO and Progressive Car Insurance

- GEICO is well-known for its catchy commercials and competitive rates, providing various coverage options.

- Progressive is recognized for its Name Your Price tool and Snapshot program, offering personalized quotes and discounts.

- Both GEICO and Progressive have a strong presence in the auto insurance market, appealing to different types of customers.

Focus on Cost Comparison

- We will compare the cost of premiums, available discounts, and overall value provided by Costco, GEICO, and Progressive.

- The goal is to determine which insurance provider offers the most affordable and beneficial option for consumers.

Coverage Options

When comparing car insurance options between Costco, GEICO, and Progressive, it's important to understand the coverage options each insurer offers. Let's delve into the differences in coverage types and limits, as well as any unique features or add-ons provided by each company.

Liability Coverage

- Costco: Costco offers standard liability coverage that helps pay for injuries and property damage if you're at fault in an accident.

- GEICO: GEICO provides liability coverage with options to customize limits based on your needs.

- Progressive: Progressive offers liability coverage with the ability to choose from various limit options.

Collision and Comprehensive Coverage

- Costco: Costco provides collision and comprehensive coverage to protect your vehicle from damages due to accidents, theft, or other incidents.

- GEICO: GEICO offers collision and comprehensive coverage with deductible options to tailor your policy.

- Progressive: Progressive includes collision and comprehensive coverage with additional perks like pet injury coverage.

Additional Features and Add-ons

- Costco: Costco may offer discounts for members or additional benefits like roadside assistance.

- GEICO: GEICO provides add-ons such as rental car reimbursement and mechanical breakdown insurance.

- Progressive: Progressive offers unique add-ons like gap insurance and custom parts coverage.

Pricing Structure

When it comes to car insurance, understanding how Costco, GEICO, and Progressive determine their rates is crucial. Each insurer considers various factors to calculate the cost of insurance for their customers. Factors such as age, driving history, and location play a significant role in determining the final price of coverage.

Additionally, each insurer offers different discounts and savings opportunities to help customers lower their insurance costs.

Factors Affecting Insurance Costs

- Age: Younger drivers typically pay higher insurance premiums due to their lack of driving experience and higher risk of accidents.

- Driving History: A clean driving record with no accidents or traffic violations can lead to lower insurance rates, while a history of accidents or tickets may result in higher premiums.

- Location: The area where you live can impact the cost of insurance, with urban areas often having higher rates due to increased traffic and crime rates.

Discounts and Savings Opportunities

- Multi-Policy Discount: Insuring multiple vehicles or bundling auto insurance with other policies, such as homeowners insurance, can lead to discounts.

- Good Student Discount: Students with good grades may be eligible for lower insurance rates.

- Safe Driver Discount: Maintaining a clean driving record and avoiding accidents can result in savings on car insurance.

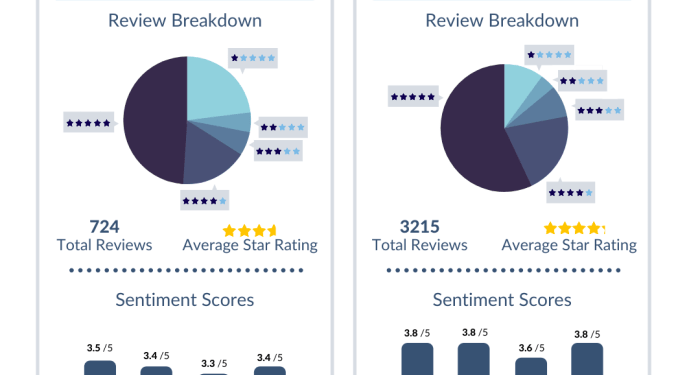

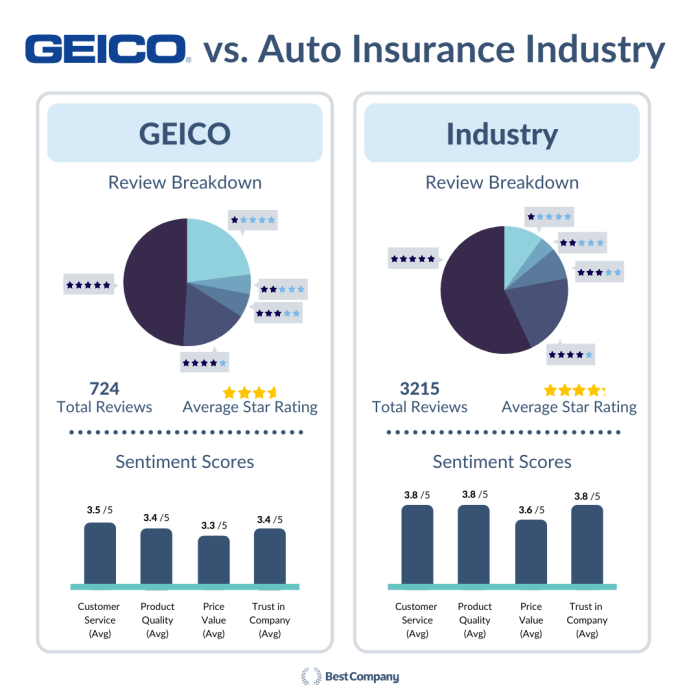

Customer Satisfaction

When it comes to choosing an insurance provider, customer satisfaction is a crucial factor. Analyzing customer reviews and ratings can give us valuable insights into the experiences of policyholders with Costco, GEICO, and Progressive. Let's take a closer look at the customer service experiences and claims processing of these insurers to determine their strengths and weaknesses in terms of customer satisfaction.

Costco

Costco's car insurance is known for its competitive pricing and excellent coverage options. However, when it comes to customer satisfaction, reviews are mixed. While some policyholders praise Costco for its responsive customer service and efficient claims processing, others have reported issues with communication and delays in claim settlements.

One of the notable strengths of Costco is its reputation for providing cost-effective insurance solutions to its members. On the other hand, a weakness could be the inconsistency in customer service quality reported by some customers.

GEICO

GEICO, one of the largest car insurance companies in the United States, has a solid reputation for customer satisfaction. Policyholders often commend GEICO for its easy-to-use online tools, quick claims processing, and helpful customer service representatives. The insurer's strengths lie in its responsive support system and hassle-free claims handling.

However, some customers have raised concerns about occasional delays in claim settlements, which could be considered a weakness in GEICO's customer satisfaction performance.

Progressive

Progressive is known for its innovative approach to car insurance and a wide range of coverage options. Customer reviews for Progressive are generally positive, with many policyholders praising the insurer for its user-friendly website, competitive pricing, and efficient claims processing.

The strengths of Progressive include its technology-driven solutions and personalized customer experience. Despite these positives, some customers have reported issues with communication and claim resolution, which could be areas of improvement for the insurer in terms of customer satisfaction.

Availability and Accessibility

When it comes to choosing a car insurance provider, availability and accessibility are key factors to consider. Let's compare Costco car insurance to GEICO and Progressive in terms of how easy it is to get a quote, make policy changes, and file claims with each insurer.

Availability of Costco Car Insurance vs. GEICO and Progressive

- Costco car insurance is only available to Costco members, which may limit its accessibility compared to GEICO and Progressive, who offer insurance to the general public.

- GEICO and Progressive have a wider reach and are more widely known in the insurance market, making them more readily available to potential customers.

Accessibility of Quotes, Policy Changes, and Claims

- Getting Quotes:Costco, GEICO, and Progressive all offer online quoting tools, making it convenient to get quotes from the comfort of your home. However, Costco's quoting tool may require membership verification.

- Making Policy Changes:GEICO and Progressive have user-friendly online portals where policyholders can easily make changes to their policies. Costco's process for policy changes may vary depending on the provider they are partnered with.

- Filing Claims:All three insurers offer online claims filing options, but GEICO and Progressive are known for their efficient claims processing and customer service. Costco's claims process may be influenced by the provider they are affiliated with.

Online Tools and Mobile Apps

- GEICO and Progressive have robust online tools and mobile apps that allow customers to manage their policies, make payments, and access important documents easily.

- Costco may offer limited online tools or mobile apps for insurance management, depending on the provider they are working with.

Additional Benefits

When comparing Costco, GEICO, and Progressive car insurance, it's essential to consider the additional benefits and perks offered by each insurer. These extra features can make a significant difference in your overall satisfaction and value for money.

Roadside Assistance

- Costco: Costco car insurance offers 24/7 roadside assistance to help you in case of emergencies like flat tires, towing, or lockouts.

- GEICO: GEICO also provides roadside assistance as an optional add-on to your policy for extra peace of mind on the road.

- Progressive: Progressive includes roadside assistance in some of their coverage options, ensuring you have help when you need it most.

Rental Car Coverage

- Costco: Costco car insurance may offer rental car coverage as an add-on to your policy, allowing you to have a temporary vehicle if yours is in the shop.

- GEICO: GEICO provides rental car coverage as an optional feature, ensuring you can still get around while your car is being repaired.

- Progressive: Progressive also offers rental car coverage to their policyholders, giving you a convenient solution in case of an accident.

Other Complimentary Services

- Costco: Costco members may benefit from discounts on auto repair services, extended warranty options, and other perks related to their car insurance.

- GEICO: GEICO offers various discounts for safe driving, bundling policies, and more, helping you save money on your premiums.

- Progressive: Progressive provides innovative tools like Snapshot and Name Your Price to customize your policy and potentially lower your rates.

Concluding Remarks

In conclusion, the analysis sheds light on the key factors to consider when choosing between Costco, GEICO, and Progressive car insurance. Whether it's cost, coverage options, customer satisfaction, or additional benefits, this discussion aims to empower readers with the information needed to make the best choice for their car insurance needs.

Detailed FAQs

Is Costco car insurance only available to Costco members?

Yes, Costco car insurance is exclusively available to Costco members, offering them unique benefits and discounts.

Does Costco offer any special perks for car insurance customers?

Costco provides additional benefits like roadside assistance and rental car coverage to enhance the overall customer experience.

Can I bundle Costco car insurance with other Costco services for more savings?

Yes, Costco offers bundling options that allow customers to save more by combining car insurance with other Costco services.